If you’ve been following the financial headlines, mortgage rates are exceedingly low right now. While credit is a bit tighter due to the COVID-19 pandemic, many institutional lenders are still putting money out the door on quality assets and will do so at attractive rates. Many borrowers who refinanced in the past few years will likely have what they consider to be a “good” rate. But how much better can your rate be?

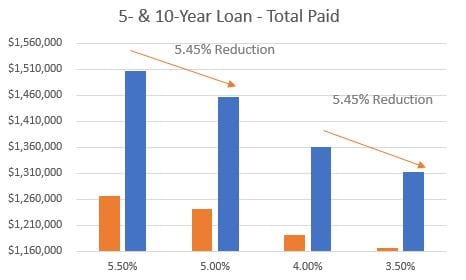

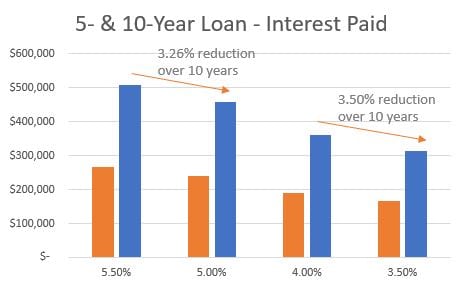

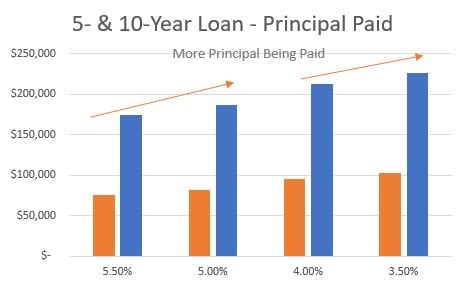

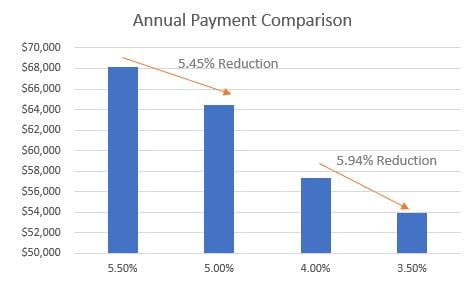

One concept that many borrowers don’t know is that all rate reductions are not created equal. A cut from 5.50% to 5.00% (50bps) is not the same as a cut from 4.00% to 3.50%. Take a look at the example below:

As you can see, at low rates, a reduction of 50bps makes an even more significant difference. When you expand that analysis over 5 and 10 years, the savings on a $1 million loan is significantly less interest and significantly more principal paid, despite a significantly lower overall payment. And as your loan gets larger, as most commercial loans are, those savings will only be amplified. If you would like to explore optimizing your interest rate, feel free to contact FinanceBoston.