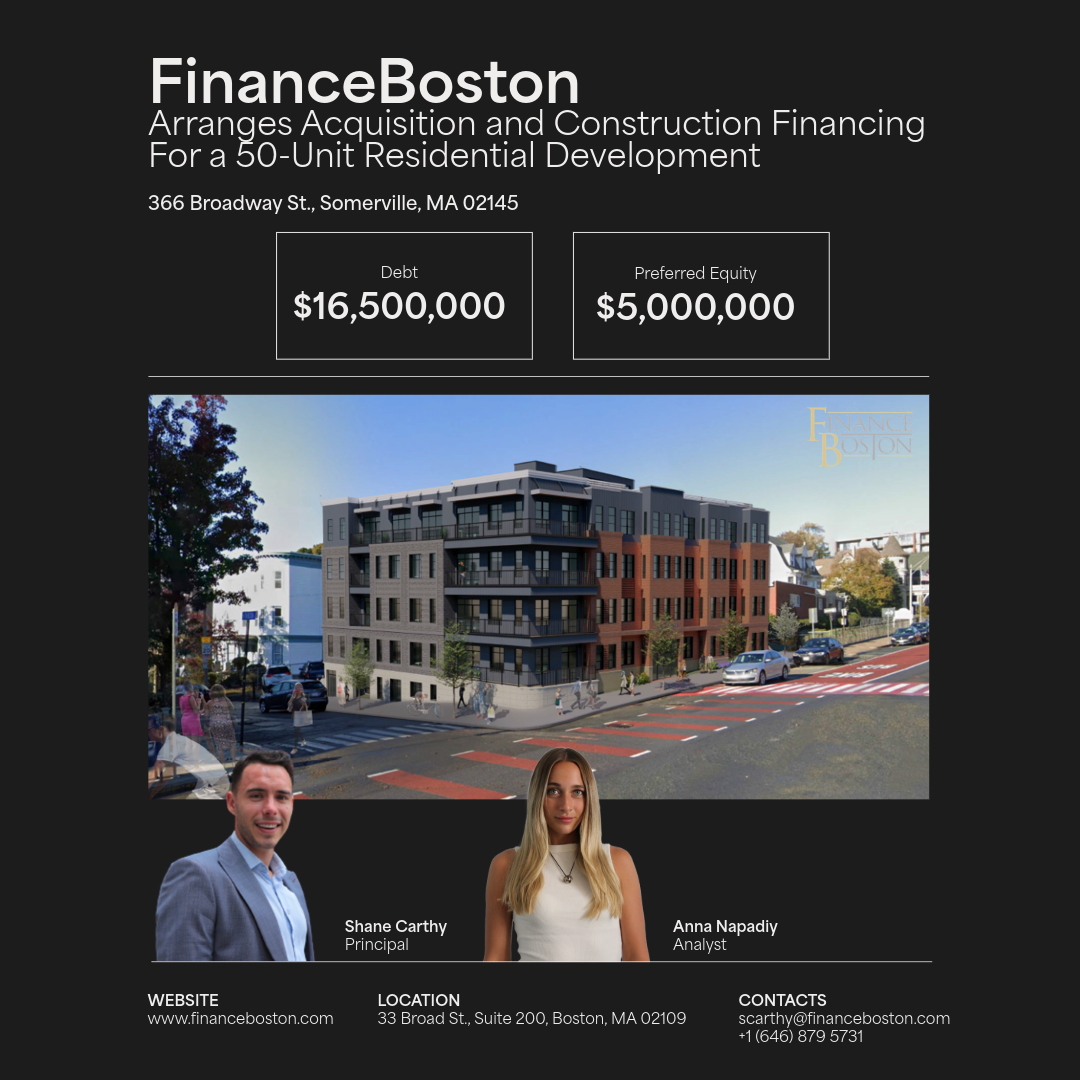

BOSTON – FinanceBoston has successfully arranged $16,500,000 in senior debt and $5,000,000 in preferred equity for the development of a 50-unit apartment community at 366 Broadway in Somerville, MA.

This financing represented one of the more complex and competitive executions completed by FinanceBoston this year. Over the course of several months, the team navigated challenging market dynamics and intricate capital structuring to deliver a successful outcome for the sponsor. The result is a financing package that supports the creation of a high-quality rental development designed to meet strong demand in Somerville’s rapidly evolving residential market.

“In today’s environment, securing both debt and equity capital for large-scale multifamily developments requires persistence, creativity, and deep relationships,” said Shane Carthy, Principal at FinanceBoston. “We’re proud to have aligned this project with long-term partners who share our conviction in the strength of Somerville’s rental market and the sponsor’s execution capabilities.”

Construction will commence shortly, adding much-needed housing to a transit-oriented corridor with direct access to the Green Line Extension and Union Square. The transaction highlights FinanceBoston’s continued ability to deliver tailored, outcome-driven financing solutions for developers operating in Greater Boston’s most competitive submarkets.

FinanceBoston remains an active advisor on debt, equity, and structured capital placements across all major asset classes, focused on achieving exceptional results for its clients in an increasingly complex real estate capital landscape.