A commercial construction loan can be a game-changer for businesses looking to fund building projects and keep operations running smoothly. Many contractors, developers, and business owners rely on these financing tools to bring their visions to life — and the number is growing every year. But while these loans offer substantial benefits, it’s crucial to approach them with strategy and foresight.

A commercial construction loan can be a game-changer for businesses looking to fund building projects and keep operations running smoothly. Many contractors, developers, and business owners rely on these financing tools to bring their visions to life — and the number is growing every year. But while these loans offer substantial benefits, it’s crucial to approach them with strategy and foresight.

What Is a Commercial Construction Loan?

A commercial construction loan is a B2B financing solution used to purchase, build, or renovate commercial properties. These loans are commonly utilized by contractors, construction companies, developers, and real estate firms to cover the costs of materials, labor, equipment, and more. Whether you’re managing cash flow or securing a new project, this type of financing helps ensure that progress doesn’t stall.

Commercial Construction Loan Best Practices

To get the most from your loan and complete your project on time and on budget, follow these key do’s and don’ts:

To get the most from your loan and complete your project on time and on budget, follow these key do’s and don’ts:

- Do: Plan Ahead

Expect multiple inspections and checkpoints throughout the process. A clear project timeline will help you stay on track and avoid costly delays.

- Do: Monitor All Payments

Stay on top of both incoming and outgoing payments. Carefully reviewing invoices and expenses can help you catch discrepancies early and prevent budget overruns.

- Do: Maintain Open Communication with Your Lender

Keep your commercial real estate lender in the loop about your project’s progress, especially if you encounter delays, cost changes, or material shortages. Prompt updates build trust and keep everything moving smoothly.

- Do: Reserve Extra Cash

Aim to have at least 15% of your total project budget in liquid cash. This cushion protects you from unplanned expenses and keeps your project moving without unnecessary stops.

- Don’t: Start Construction Before Loan Closing

Kicking off your project too early could delay your closing or threaten your loan approval. If time is tight, speak with your lender about interim financing options.

- Don’t: Make Changes Without Notifying Your Lender

Adjustments to the project are common, but always consult your lender before moving forward. Unapproved changes can breach your loan agreement and risk funding.

- Don’t: Take Out Additional Financing Without Permission

If unexpected expenses arise, talk to your lender before seeking outside funding. They may offer solutions or guidance tailored to your situation.

- Don’t: Miss Loan Payments

Timely payments are crucial. Falling behind not only increases your interest costs but can also hurt your credit and strain your relationship with the lender.

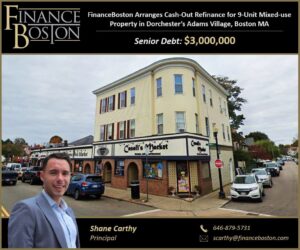

Partner with FinanceBoston, Inc. for Smart Commercial Construction Financing

Whether you’re building from the ground up or renovating an existing property, FinanceBoston, Inc. offers expert guidance and tailored financing solutions to support your goals. Our team understands the complexities of commercial construction and works closely with you every step of the way.

At FinanceBoston, Inc., we understand that every commercial construction project is a significant investment — not just in money, but in your company’s future. That’s why we go beyond just lending. We partner with you to structure a customized financing solution that fits your goals, timeline, and budget.

Whether you’re developing a new property, expanding your operations, or renovating an existing space, our experienced team is here to guide you through every step of the lending process. From application to closing — and beyond — we’ll help you navigate potential roadblocks and keep your project on track.

Ready to move forward with confidence? Contact FinanceBoston, Inc. today to speak with a commercial lending expert. Let us help you secure the funding you need — with the strategic insight, responsive support, and trusted experience your business deserves.

FinanceBoston, Inc.

33 Broad Street

Boston, MA 02109

617-861-2041

https://financeboston.com/